Business leaders trust our technology.

We have partnered with the best banks and NBFCs.

Fixed deposits are a popular choice for those seeking a safe investment with minimal risk, offering peace of mind.

Fixed deposits are a popular choice for those seeking a safe investment with minimal risk, offering peace of mind.

A long-term fixed deposit plan is ideal for building wealth for future goals, like retirement or children’s education.

Preferred Investment

Fixed deposits are a popular choice for those seeking a safe investment with minimal risk, offering peace of mind.

Stable Growth

Fixed deposits provide a steady rate of return, allowing investors to grow their wealth without market fluctuations

Long-Term Benifits

A long-term fixed deposit plan is ideal for building wealth for future goals, like retirement or children’s education.

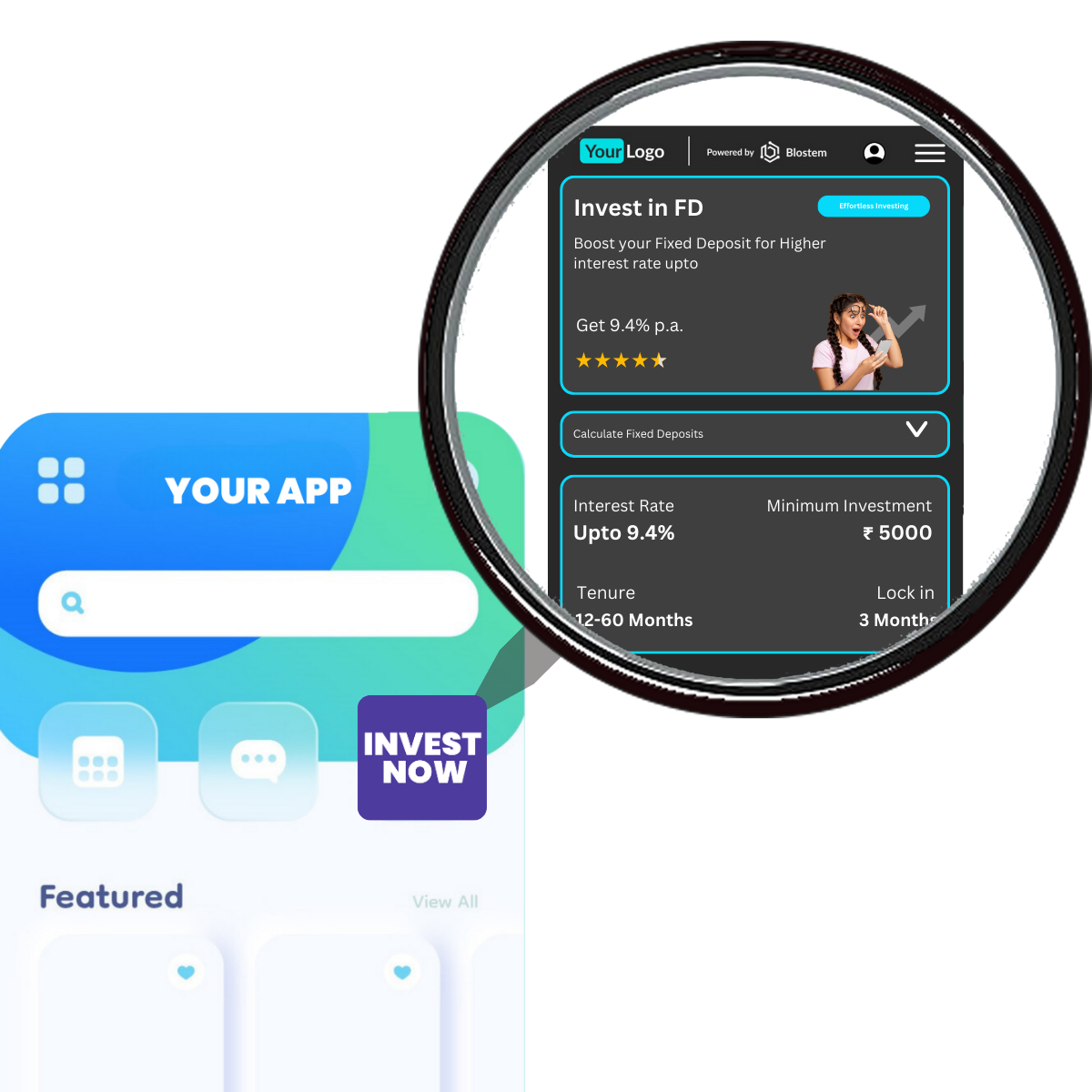

Utilise Blostem’s Plug-N-Play solution to seamlessly integrate Fixed Deposits into your digital platform, keeping you ahead of the competition.

Offering FDs not only generates additional revenue but also provides opportunities to upsell other financial products, maximising your platform’s earning potential.

You will only benefit by providing FD; you are adding more product offerings to your app, which leads to an increase in customer satisfaction and retention, allowing growth.

Advanced Technology

Utilise Blostem’s Plug-N-Play solution to seamlessly integrate Fixed Deposits into your digital platform, keeping you ahead of the competition.

Boost Revenue

Offering FDs not only generates additional revenue but also provides opportunities to upsell other financial products, maximising your platform’s earning potential.

Gain Benefits

You will only benefit by providing FD; you are adding more product offerings to your app, which leads to an increase in customer satisfaction and retention, allowing growth.

Customers can invest in FDs without opening a new bank account. They can simply purchase an FD from their chosen issuer and use their existing bank account to receive interest payments.

Gone are the days of visiting branches and filling out forms. With our digital solution, everything is paperless, saving time and effort for your customers.

Our FD purchasing process is completely transparent, with no hidden fees. Customers can buy FDs seamlessly without any additional charges for forms or account creation.

No New Account

Customers can invest in FDs without opening a new bank account. They can simply purchase an FD from their chosen issuer and use their existing bank account to receive interest payments.

No Paperwork

Gone are the days of visiting branches and filling out forms. With our digital solution, everything is paperless, saving time and effort for your customers.

No Fees

Our FD purchasing process is completely transparent, with no hidden fees. Customers can buy FDs seamlessly without any additional charges for forms or account creation.

Offer Fixed Deposits (FDs) from leading banks and NBFCs on your platform hassle-free.

Partner with us to provide your customers with the most preferred investment option.

Expand your product offerings effortlessly.

Sell your Fixed deposits (FDs) digitally on multiple distribution platforms.

Partner with us to expand your customer reach and increase your revenue.

Join our network to unlock new growth opportunities.

Offer Fixed Deposits (FDs) from leading banks and Non-Banking Financial Companies (NBFCs) on your platform hassle-free. Partner with us to provide your customers with the most preferred investment option.

Expand your product offerings effortlessly.

Sell your Fixed deposits (FDs) digitally on multiple platforms. Partner with us to expand your customer reach and increase your revenue.

Join our network to unlock new growth opportunities.

Blostem’s solution is designed for financial services business platforms to seamlessly integrate Fixed Deposit (FD) products. It is also ideal for banks and Non-Banking Financial Companies (NBFCs) looking to expand and sell their FDs through various digital platforms.

Yes, we have partnered with top-tier banks and NBFCs, all of which are regulated by the Reserve Bank of India (RBI) and the Deposit Insurance and Credit Guarantee Corporation (DICGC), providing insurance coverage up to ₹5 lakhs.

Yes, the integration process is straightforward and seamless, with multiple options such as API, SDK, and white-label solutions. You can choose the integration method that best suits your platform and launch FDs smoothly.

Absolutely. Our solution can be customized to match your brand’s logo and color theme, ensuring a consistent look and feel across your platform.

Blostem’s solution is designed for financial services business platforms to seamlessly integrate Fixed Deposit (FD) products. It is also ideal for banks and Non-Banking Financial Companies (NBFCs) looking to expand and sell their FDs through various digital platforms.

Yes, the integration process is straightforward and seamless, with multiple options such as API, SDK, and white-label solutions. You can choose the integration method that best suits your platform and launch FDs smoothly.

Yes, we have partnered with top-tier banks and NBFCs, all of which are regulated by the Reserve Bank of India (RBI) and the Deposit Insurance and Credit Guarantee Corporation (DICGC), providing insurance coverage up to ₹5 lakhs.

Absolutely. Our solution can be customized to match your brand’s logo and color theme, ensuring a consistent look and feel across your platform.